Small Business Lending News: Small Business Owners Falling Through the Cracks of Popular SBA Loan Program

A recent Wall Street Journal Article titled "Those Seeking Loans Are Left in the Lurch by Erratic Funding," highlighted the a small business owner's story as he slipped through the cracks of the lending process for loans backed by the Small Business Administration.

A recent Wall Street Journal Article titled "Those Seeking Loans Are Left in the Lurch by Erratic Funding," highlighted the a small business owner's story as he slipped through the cracks of the lending process for loans backed by the Small Business Administration.

Bill Cimino was approved for a $1.6 million loan last year to purchase the property on which his Wilmington, Mass., car dealership sits. The loan was backed by the Small Business Administration and—thanks to the government stimulus program—carried no borrower fees and provided his lender with a substantial guarantee against default.

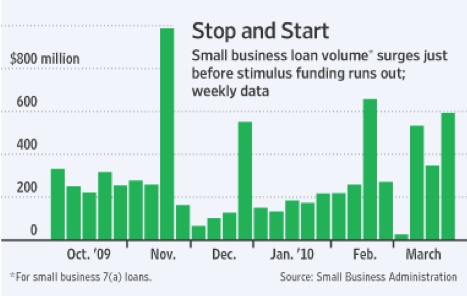

The loan was scheduled to close at the end of December, to coincide with the end of his lease, but paperwork delays pushed it until February—just as the stimulus money for the program ran out.

This is an interesting article and dilemma. The SBA loan program is a great product but the vender (bank) has to be equally as good and that is often difficult to assess. The SBA should not take the full blame for erratic funding - especially since it's really the banks that are notorious (to insiders) for not telling the complete truth about their lending capabilities. The SBA is a guarantee and not a government disbursement, and there has been no recent reports of the drying up of loan guarantees from the SBA. More likely, the bank may have been constrained and pushed off the problem to the SBA.

The article also mentions issues with paperwork delays that may have just been the bank marking time since they did not actually want to lend or have the money to lend. But in the meantime, the business development officer may have enjoyed having the deal in the pipe, with little regard for how these actions would affect the business owner.

It is also important to note that there are some nuances to the SBA program regarding the collateral they require and collateral they do not. Many times you can limit the SBA collateral to specific assets which will allow you to borrow more from a different source to provide additional working capital for your business. Additionally, small businesses should be aware that they can unlock credit with alternative financing solutions.

Read more about Securing Small Business Loans for Working and Growth Capital.

There definitely needs to be more said about small business lending as it is a fragmented industry. So I'm glad to see the section of the Wall Street Journal addressing this.

See additional highlights from Emily Maltby's WSJ article are below:

- Lenders have historically issued loans backed by the Small Business Administration as a means to accommodate some of their more-risky Main Street customers because up to 75% of the loan would be reimbursed by the government in the case of default.

- In the government's most recent fiscal quarter, the number of 7(a) loans—the SBA's most popular form of funding—jumped to 16,558, twice as many as in the year-earlier quarter. The total dollar amount more than doubled, hitting $3.75 billion. But in the depths of the credit crunch, lenders weren't enticed by the 75% guarantee and SBA lending plummeted. That prompted Congress to include provisions in last February's Recovery Act that temporarily boosted the government guarantee to 90% and dropped fees associated with the loans.

- In total, $600 million has been allocated to the program, which has supported more than $23 billion in loans.

To find out more about how your business can secure the funding it needs, visit http://www.uscapitalpartners.net or call (415) 882-7160.