Recent News in Small Business Lending: Get the Financing You Need

How to secure optimal financing for your small business when most bank credit standards remain tight and small companies remain underserved by the big banks.

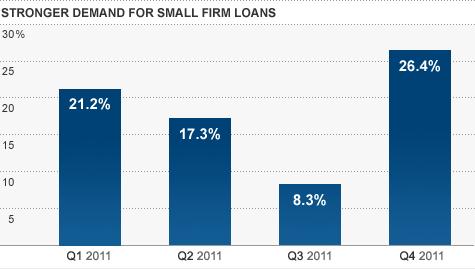

FED: Demand for Small Business Loans Jumped in 2011

The latest Federal Reserve figures reveal that many banks reported increased demand for loans from smaller businesses late last year. In the fourth quarter of 2011, 26% of respondent banks experienced “moderately stronger” demand for commercial and industrial loans from small businesses, up from 8% in the previous quarter.

The latest Federal Reserve figures reveal that many banks reported increased demand for loans from smaller businesses late last year. In the fourth quarter of 2011, 26% of respondent banks experienced “moderately stronger” demand for commercial and industrial loans from small businesses, up from 8% in the previous quarter.

Bank Credit Standards Remain Tight

As reported by CNNMoney, the survey also revealed that 94% of respondent banks said credit standards for small firms “remained basically unchanged.” Thus, despite the higher demand, retail banks have kept the strict credit standards they adopted in the wake of the 2008 recession. They have also not increased the maximum size of credit lines or eased their requirements on collateral.

Small Businesses Remain Underserved by Larger Banks

Recently, the Wall Street Journal reported that US banks posted their biggest quarterly increase in lending in four years. However, much of this growth came from large commercial clients. According to the NSBA, nearly one-third of small-businesses (30%) still struggle to secure the financing they need. Small businesses have also reported drops in bank loans, with 17% of small-business owners reporting less favorable terms on their loans in the last year.

Getting the Small Business Financing You Need

US Capital Partners, LLC, a leading lender and advisor to small businesses, is able to secure the best possible financing for your small business when the big banks say “no.” This may be as simple as financing your small business directly, or it may involve finding the right mix of specialty lenders for your circumstances and coordinating between them. US Capital Partners is a lender, co-lender, and lead financial arranger. This enables the firm to pursue its goal of engineering optimal and bespoke financing solutions for all its clients.

If you would like to know more about how your business can secure the funding it needs, email Jeffrey Sweeney, CEO and Managing Director, at jsweeney@uscapitalpartners.net or call (415) 889-1010.