From Distress to Success: Overcoming Common Financing Issues

Why businesses struggle through inadequate or poorly structured financing, and how US Capital Partners, LLC can provide the intelligent, long-term financing your business needs to prosper.

Last year, there were over 47,800 business bankruptcy filings in the US, according to the American Bankruptcy Institute. While this represents an improvement from 2010, it is still 69% higher than 2007 figures. Most companies that file for bankruptcy are smaller enterprises.

Common Financing Problems that Lead to Distress

There are many factors that can push a small business over the edge, not least the macro-economic climate. At US Capital Partners, LLC, however, we regularly come across promising smaller businesses that run into problems simply because they lack sufficient working capital or are locked in an inappropriate financing structure. The following issues are fairly common:

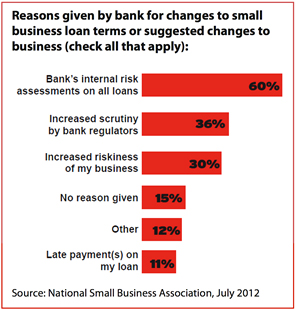

- The bank imposes more stringent loan terms or requests changes to a business (as the NSBA highlighted recently).

- A company’s current loan structure prevents the enterprise from being able to obtain additional financing to fund growth or pay its rising bills (see case study).

- A company undergoes some temporary difficulty and inadvertently breaches a loan covenant, prompting the bank to put the company into workout (see case study).

How US Capital Partners Can Help

Many smaller companies do not know where to turn to get the suitable financing they need. In many cases such businesses fall outside the criteria for traditional bank lending. They may not always understand how they can leverage their tangible and intangible business assets to secure financing, or how to structure their financing in an optimal, cost-effective way.

US Capital Partners has a proven and well-developed capability for providing working capital and growth capital for small businesses. The firm can provide financing for almost any company with assets, helping an enterprise transition from distress to strong business growth.