Investment and Capital Markets Outlook: Top Five Themes in 2022

By Jeffrey Sweeney

Chairman and CEO at US Capital Global

1. Another year of accelerated growth for FinTech

In 2021, global funding for FinTech exceeded that of the past year by 96%. Digital transformation will continue to accelerate this year, which will likely be reflected in a continued increase in FinTech M&As. Last year witnessed the rise of contactless payments, neobanks, and buy-now-pay-later (BNPL). We expect to see further innovation in the seamless integration of financial services into traditionally non-financial platforms. This will be a year in which financial institutions will increasingly try to develop more sophisticated FinTech strategies.

At US Capital Global, we continue to lead the way in FinTech in our industry, levelling the playing field and providing wider access to wealth creation. Since 1998, we have been leveraging the latest FinTech and RegTech innovation to provide lower middle market businesses and investors with sophisticated debt, equity, and investment opportunities usually available only to larger companies and institutional investors.

2. The continued mainstreaming of crypto assets

Cash in worldwide crypto funds more than doubled in 2021. Crypto investment managers had $62.5 billion in assets at the end of 2021, while crypto funds attracted record inflows of $9.3 billion in 2021, up from $6.8 billion in 2020, as institutional adoption grew. Despite ongoing volatility and some ongoing security concerns, crypto assets will have another strong year and enjoy broader mainstream recognition in 2022. Now a multi-trillion-dollar asset class, crypto is on the radar of fund managers and family offices, and will continue to garner both retail and institutional investor participation in 2022.

As more businesses accept Bitcoin as legal tender in 2022, the viability and values of cryptos will increase. We will likely see increased partnerships between traditional financial service providers and crypto-enabled services, with more sophistication in the interaction between crypto and legacy financial institutions. Crypto equity will continue to provide ease of access and globalization, thereby offering a significant advantage for capital raises.

At US Capital Global, we plan to launch a crypto fund of funds in 2022, designed especially for institutional investors, who will be able to invest in crypto assets without headline risk or the need to set up crypto wallets. We are also in discussions to acquire several regulated crypto asset managers, reflecting rising demand from our clients for crypto assets.

3. The coordination of RegTech across platforms and jurisdictions

As the financial ecosystem continues to rapidly change, regulatory enforcement will try to make up for lost time in 2022. We can expect to see increased regulatory scrutiny in many aspects of FinTech, in particular BNPL and crypto. Anonymity, lack of traceability, and the global reach of crypto-assets can make crypto a tool for bad actors to perpetuate financial crime. Regulators globally are intensifying their search for negligent practices and market abuse. In the US alone, we are already seeing significant jurisdictional overlap in digital asset regulation, with several states racing ahead to amend securities and banking laws to include crypto-related activities.

At US Capital Global, we are strongly in favor of sensible regulation, which in our view requires the harmonization of digital asset regulation across jurisdictions and across platforms. The global scope of digital asset trading means regulatory issues reach beyond the remit of any single regulator or jurisdiction. US Capital Global is currently reaching out to regulators in different jurisdictions to promote a more coordinated international response by regulators.

4. Alternative investments provide a natural interest rate hedge to reduce volatility-based risks

A study by Preqin shows that between 2020 and 2025, global assets under management in alternatives are set to increase by 60%, far outpacing global GDP and inflation. The alternatives industry is expected to reach $14 trillion by 2023, with private equity and private debt leading the way.

Financial stimulus in response to the unprecedented economic shutdown caused by COVID-19 is driving inflationary pressures, and investors are actively seeking higher interest rates for their fixed-income investments. Investors have been more attuned to the importance of balancing traditional fixed-income portfolios with alternative fixed-income investments, such as private debt, business credit funds, venture debt, convertible notes, and more. In looking for ways to mitigate the effects of rising inflation and weather the market’s ups and downs, investors will increasingly turn to alternative fixed-income investments in 2022.

At US Capital Global, we are specialists in alternative investments. In a climate of higher inflation, we can help our clients mitigate the inevitable damage to their portfolio with higher interest rates through alternative fixed-income investments.

5. The rise of “frontier assets”

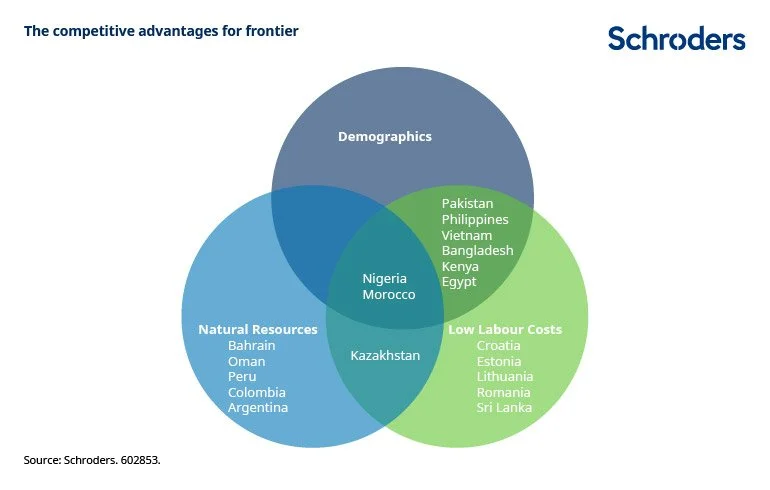

Frontier emerging markets (FEMs) offer some of the most exciting investment opportunities globally. In general, FEMs are countries with smaller, less liquid equity markets that often have reduced operational capabilities and foreign investor access limits. Their competitive advantages lie in low labor costs, young populations, and natural resources. FEMs make up nearly 1 billion people, almost 15% of the global total. Their aggregate GDP is one-eighth that of emerging markets and one-twentieth that of global GDP, but their capital markets are under-represented.

COVID-19 underscored the need for many of these countries to liberalize, attract FDI, and expand their export bases, thereby allowing them to reduce their dependency on tourism and increasing their resilience to global shocks. In 2022, US Capital Global will be developing new FEM-related investment products to capitalize on the opportunities these markets offer.

Jeffrey Sweeney is a fund manager with years of experience in direct lending and corporate finance for lower middle market businesses. He is Chairman and CEO at US Capital Global (www.uscapglobal.com), a full-service global private financial group headquartered in San Francisco with offices on four continents. The group aims to invest in companies that address the world’s major social and environmental challenges, while generating long-term wealth for investors.

Securities offered through US Capital Global Securities, LLC (“USCGS”), member FINRA/SIPC. This article is for your information only and is not an offer to sell, or a solicitation of an offer to buy any securities or instruments. Any such offer or solicitation shall be made only pursuant to the confidential private placement memorandum and supporting documents, as amended or supplemented from time to time. The information has been obtained or derived from sources believed by us to be reliable, but we do not represent that it is accurate, complete, or timely. Any opinions or estimates contained in this information constitute our judgment as of this date and are subject to change without notice. USCGS or its affiliates may provide advice to, be compensated by, or hold debt or equity positions in the companies noted herein. View USCGS’ Form CRS at www.uscgs.com/crs.html.